The current financial model of banks cannot address what development experts call the “triple whammy” of poor peoples’ lives – they struggle with low savings, uncertainty of cash flows, and the inability to access formal financial instruments. Small farm holders in the developing world face similar struggles as they often have to purchase seeds and fertilizers in one large payment to improve their harvest. MyAgro, provides an innovative alternative to farmers, eliminating the need for banks and placing financial decision-making in the hands of small farm holders.

MyAgro helps farmers purchase agricultural tools on layaway via an SMS platform and a network of local vendors. Anushka Ratnayake started myAgro in 2011 as a pilot program in Mali and soon expanded it to Senegal. MyAgro’s success can be attributed to their approach of using a mobile phone platform to adapt current pro-poor financial methods to addressing the financing problem in the agricultural sector.

How does myAgro work?

MyAgro works much like someone going to top up their phone for additional talk time at their local store. Participating farmers purchase scratch-off cards (ranging from $.50 to $10) with a unique pin number. This pin number is sent to myAgro and is recorded in their database under the farmer’s profile. An SMS is sent back to the farmer notifying them of how much they have saved towards their goal (to purchase fertilizer, seeds, or agricultural training). Once this amount is reached, the farmer receives the tools or service they have purchased from myAgro.

Why does myAgro’s model work?

MyAgro’s model gives rural farmers access to key financial services including cash-flow management and savings, through this approach:

- Reliability

Without the credit and collateral that banks require when opening a savings account, poor people have responded by forming rotating savings and credit funds (ROSCAs) within their communities. This has been replicated worldwide, helping families manage scarcities. However, this informal tool does not provide the accountability, reliability and privacy that banks would offer. MyAgro builds on the success of ROSCAs, where people save through small incremental amounts over the long-term, but with the security and reliability of a formal mobile platform. - Convenience

MyAgro clients don’t have to travel long distances to access banks, which is especially useful for rural farmers living in remote areas where bank branches do not exist. MyAgro also increases inclusion by making the system easy to use, especially for those who are illiterate. Getting the basic use out of myAgro only requires the farmer to SMS the numbers located on the card they purchased. In addition, no physical cash is involved. In mobile cash transfer platforms such as the successful M-PESA program, some local vendors run out of cash when a customer wants to conduct a transaction, myAgro only relies on digital transactions – a successful approach within cash-strapped countries. - Flexibility

By allowing farmers to choose how much to save on a given day, myAgro takes into account the variety of shocks that vulnerable populations experience, such as illness in the family or natural disasters. The mobile platform allows them to use their small-scale savings for large-scale purchases.

In just three years, myAgro has managed to address a debilitating financial problem in farming communities in the developing world by providing a reliable and accessible savings tool and allowing farmers to managing their cash flows on their own terms. I look forward to seeing how myAgro expands its current 6,000 farmer membership while also collaborating with other mobile technology platforms to continue providing information and financial services to the benefit of the poor.

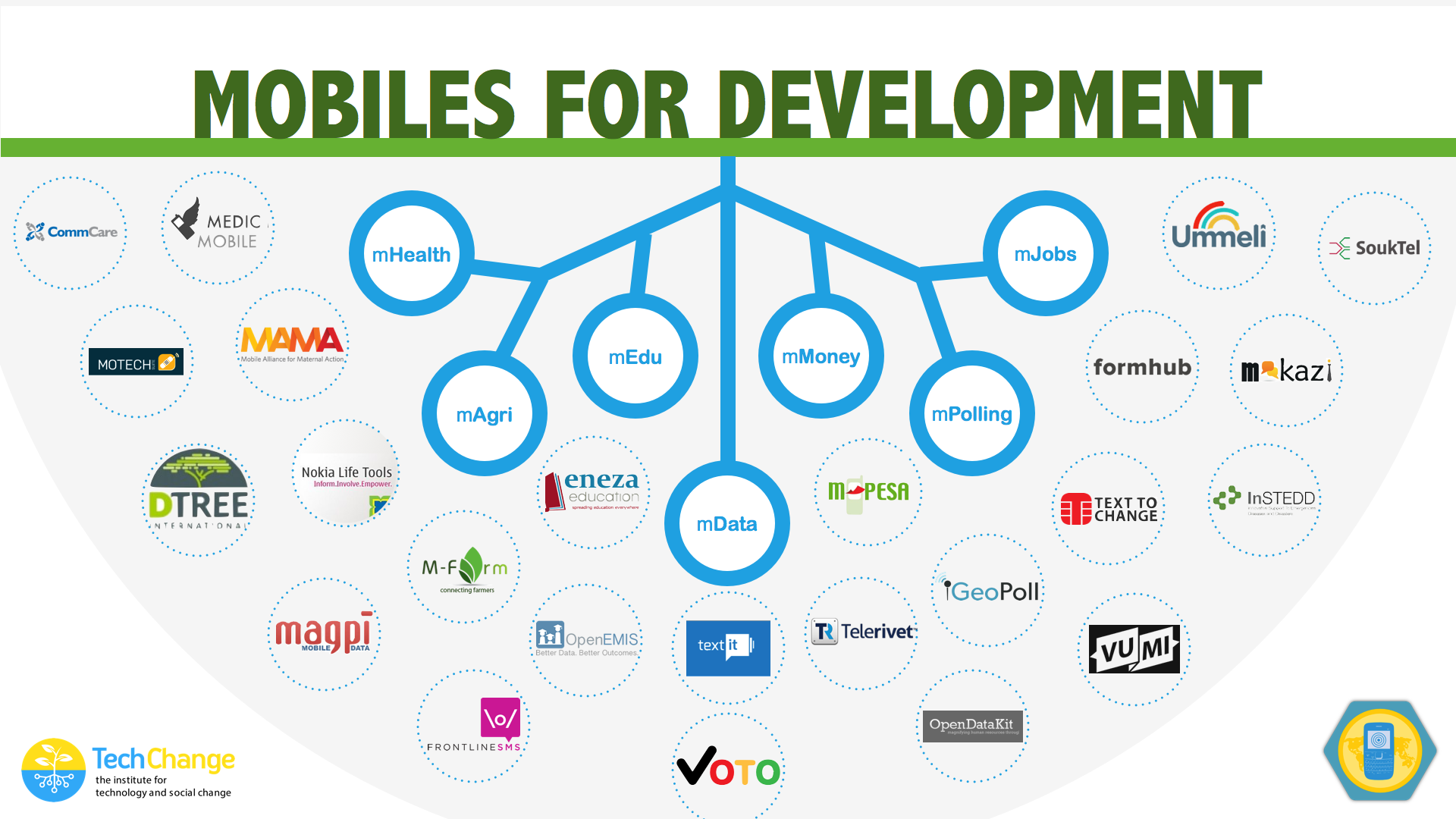

Interested in learning more about other ways mobile phones are empowering people in the developing world? Join us in our upcoming course, Mobile for International Development that begins on May 11.

About author

Ana Tamargo is a development professional and recent graduate from the Elliott School of International Affairs, George Washington University. She recently received a master’s degree in International Development Studies. During this time, Ana completed TechChange’s “Mobile Phones for International Development” course in order to advance her knowledge in using innovative information and communication technologies to facilitate programming and data collection within the local context. She has worked at international NGOs such as Pact, World Cocoa Foundation, and the Rainforest Alliance and has expertise in program advancement, evaluation and research in the fields of sustainable natural resource management, rural poverty alleviation, and bottom-up development. Ana is eager to continue findings ways to incorporate mobile phone technology in helpingempower and provide services to vulnerable populations.